SAFE AND SECURE ONLINE CHECKING.

Now with EVEN MORE added benefits.

A GFCU MyAdvantage Checking account is everything you want out of a checking account, plus so much more.

MyAdvantage Checking account bonus offers: Telehealth5,10, Dark Web Monitoring5 and Enhanced Cell Phone Protection up to $6006,7. All of that PLUS the same great features you’ve already come to love, including same-day direct deposit1, IDProtect®, Credit File Monitoring5,9, $hopping RewardsTM,3, and more – all for a low monthly service fee of only $5.95.

Don't Settle for a Standard Checking Account

MyAdvantage Checking from GFCU gives you:

- Telehealth5,10 – Access to 24/7 video or phone visits with board-certified, licensed doctors. Zero copays

- Cell Phone Protection6,7 of up to $600

- $hopping RewardsTM,3 – Enjoy exclusive offers and discounts at thousands of leading online retailers

- Monthly Credit Score5,9 update and bi-annual Credit Report

- IDProtect® with identity theft expense reimbursement coverage8 and resolution services

- Dark Web Monitoring5– Receive alerts when your personal information is exposed on the dark web

- Debit Advantage® – Buyer’s Protection and Extended Warranty on items purchased with your MyAdvantage Checking Account

- Travel & Leisure Discounts4

- Health Savings Discounts (this is NOT insurance)5

- AD&D Insurance7

Choose the checking account that's right for you.

Generations’ consumer checking options include Basic Checking, MyAdvantage Checking and MyAdvantage Plus Checking. Review details to see which is best for you.

Coverage

Monthly Fee

Get Paid Up To 2 Days Early1

Minimum Opening Balance

Earns Interest*

Visa® Debit Card REWARDS2

Visa® Debit Card & Online/Mobile Banking Access

ZELLE®

Bill Pay Service

Access to CO-OP ATM Network

One (1) Box of Free Standard Checks Per Calendar Year

Four (4) Complementary Money Orders Per Calendar Year

Four (4) Complementary Cashier's Checks Per Calendar Year

Telehealth5,10

Dark Web Monitoring5

Cell Phone Protection6,7

Identity Theft Protection & Resolution Services8

Credit Monitoring & Credit Score5,9

Credit Report5

Accidental Death & Dismemberment Coverage7

$hopping RewardsTM,3

Travel and Leisure Discounts4

Health Discount Savings5

Roadside Assistance7

DEBIT CARD REWARDS: With MyAdvantage Checking, earn rewards on your transactions that can be used for gift cards, cash back, travel & more!

View Rewards in Online/Mobile BankingMOBILE APP - MyBenefits

Already have a MyAdvantage Checking Account?

Access and manage your full suite of account benefits by visiting the MyBenefits website or downloading the app for iPhone or Andriod.

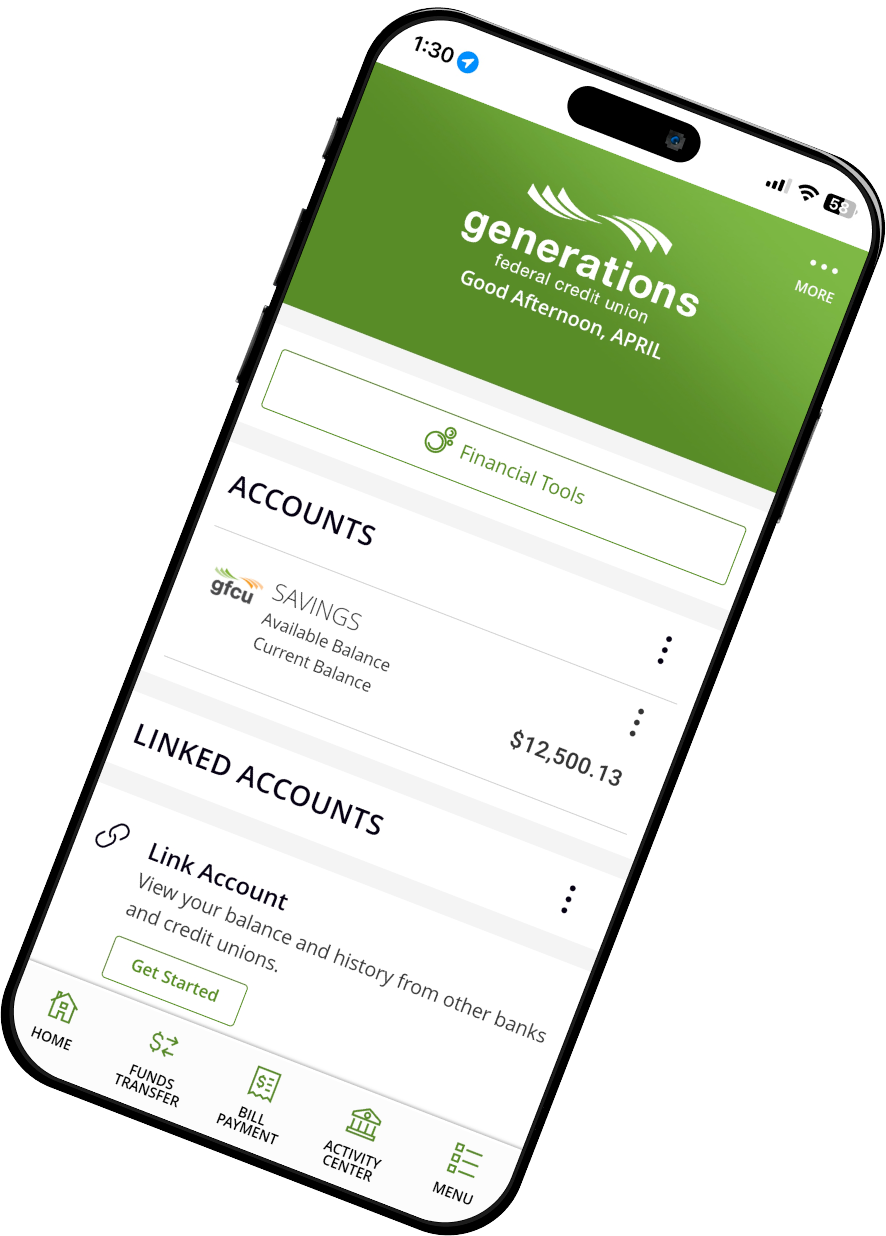

MOBILE BANKING

Manage Your Account With Ease

View balances, make transfers and more by downloading our mobile app.

Learn more about the GFCU MyAdvantage Checking Account with our most frequently asked questions.

We offer three personal checking account options: Basic, MyAdvantage, and MyAdvantage Plus. You can see the three accounts compared here: Checking Accounts.

No. When you open a checking account with us, you’ll receive a personalized debit card at no additional cost.

Yes. Eligible members can use Smart Deposit on their mobile app to deposit checks.

There is no fee to use our Basic Checking account. Our MyAdvantage Checking account is $5.95 per month, and our MyAdvantage Plus Checking account is $8.95 per month; but, with those minimal monthly fees comes substantial value-added savings. There are benefits such as telehealth, identity theft protection and monitoring, cell phone protection, travel and leisure discounts and shopping rewards, just to name a few!

Not a Generations Member Yet?

There are many ways to become a member, and you can establish your membership with just $5. There are also many benefits to becoming a member of a credit union, including access to dividend-yielding savings and deposit accounts, as well as competitive loans and credit products.

Ready to become a Generations member and open your account?

Questions? Get Contacted.

*MyAdvantage Plus – Balance $2,000 or less: 0.00% APY, $2,000.01-$25,0000: 0.05% APY, $25,000.01-$50,0000: 0.10% APY, $50,000+: 0.10% APY; MyAdvantage – 0.05% APY. APY is Annual Percentage Yield. Published rates and APYs are subject to change daily. Fees and other conditions could reduce earnings on the account. View complete Checking Account rates here.

**No monthly service fees will be assessed for the first three (3) statement cycles, or ninety (90) days, following the date of account opening for any MyAdvantage Plus Checking Account opened on or before March 31, 2026.

1Receive your direct deposit funds the same day they are received by the credit union.

2Earn 1 point for every $5 spent (signature transactions) and 1 point for every $10 spent (PIN transactions) to redeem for gift cards, cash back, travel, merchandise, donations and more.

3Registration/activation required; available via mobile or web only.

4Available via mobile or web only.

5Registration/activation required.

6Cellular telephone bill must be paid using eligible account.

7Special Program Notes: The descriptions herein are summaries only and do not include all terms, conditions and exclusions of the benefits described. Please refer to the actual Guide to Benefit and/or insurance documents for complete details of coverage and exclusions. Coverage is provided through the company named in

the Guide to Benefit or on the insurance document. Insurance Products are not insured by the NCUA or any Federal Government Agency; not a deposit of or guaranteed by the credit union or any credit union affiliate.

8MyAdvantage Plus: Benefits are available to personal checking account owner(s), their joint account owners and their eligible family members. Family includes: Spouse, persons qualifying as domestic partner, and children under 25 years of age and parent(s) of the account owner who are residents of the same household. MyAdvantage: Benefits are available to personal checking account owner(s), and their joint account owners subject to the terms and conditions for the applicable Benefits.

9You will have access to your credit report and score provided your information has been verified by the CRA. Credit score is a VantageScore 3.0 based on TransUnion data. Third parties may use a different type of credit score to assess your creditworthiness.

10MyAdvantage Plus: Available for the account holder(s) and their spouse/domestic partner and up to six (6) dependent children age 2 and older. This is not insurance. MyAdvantage: Available for the primary account holder and their joint account holder(s). This is not insurance.